A Practical Guide to AI for Store Owners

What AI can actually help with, what it can't, and how to tell the difference.

Dec 23, 2025

Nick Hershey

AI has gotten genuinely better over the past few years. The tools today can do things that weren't possible even two years ago. That part is real.

What's also real: the hype has outpaced the substance. Every software company now claims to be "AI-powered." Vendors promise transformation without explaining what that means. The marketing has gotten louder while the explanations have stayed vague.

Andrew and I want to cut through some of that. This guide will help you understand what AI actually is, give you three weeks of hands-on practice, and teach you how to evaluate the tools and vendors you'll encounter. Whether you use Rundoo or not, this knowledge will serve you well.

Part 1: Understanding AI

Before using these tools, it helps to understand what you're working with.

When people refer to AI today, they typically mean large language models, or LLMs. These power ChatGPT, Claude, Gemini, and a couple others.

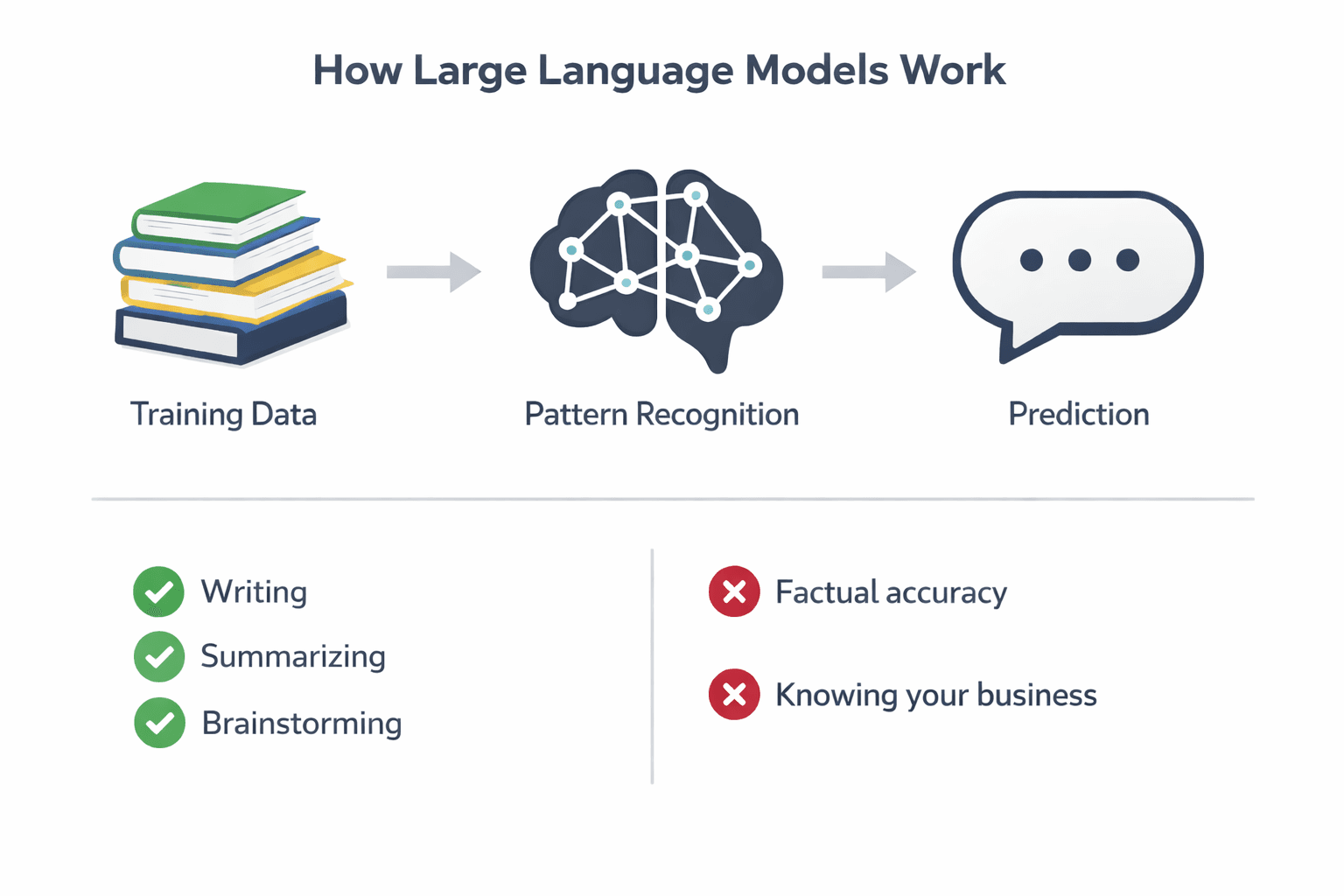

The core concept: these systems learned language by analyzing enormous amounts of text—nearly the entire internet of websites, articles, forums, and billions of pages in total. They identified patterns in how people write and communicate. When you ask ChatGPT a question, it isn't searching a database for the answer. It's predicting, word by word, what a useful response would look like based on those patterns.

This explains both why these tools are useful and why they behave strangely at times.

They excel at language tasks: writing, summarizing, explaining, brainstorming. They've processed so many examples of effective communication that they can produce it on demand.

However, they also fabricate information. Because they predict plausible responses rather than retrieve verified facts, they sometimes generate confident-sounding answers that are entirely wrong. This is called "hallucination." It isn't a bug being fixed—it's fundamental to how these systems work. You need to understand this going in.

The other significant limitation: they know nothing about your business.

These models were trained on public information from the internet. They have general knowledge about hardware stores and farm supply, certainly. But they've never seen your sales, your inventory, or your customers. Ask ChatGPT which SKUs you should reorder and it will provide an answer—but it's inventing that answer. It has no knowledge of what you sell.

The major AI companies (OpenAI makes ChatGPT, Anthropic makes Claude, Google makes Gemini) sell access to these models in various ways. Some offer free versions, others charge subscriptions. Worth noting: some free tools use your conversations to improve their systems, which matters when you're entering business information.

Part 2: Using AI — 3 Weeks of Practice

Week 1: Initial Exploration

Select one of the major tools and begin using it. ChatGPT is the most widely used. Claude and Gemini function similarly. All offer free versions.

Suggested exercises:

Decode a contract. Take that contract with the clause you've been meaning to understand. Paste it in and ask for a plain English explanation.

"Explain this contract clause in plain English. What am I agreeing to, and what should I watch out for?"

Write a job posting that stands out. Describe what makes working at your store different and see what the AI produces.

"Write a job posting for a part-time sales associate at my hardware store. We're a small, family-owned store in [town]. We want someone who likes helping people solve problems, not just ringing up sales. Keep it under 150 words and make it sound human, not corporate."

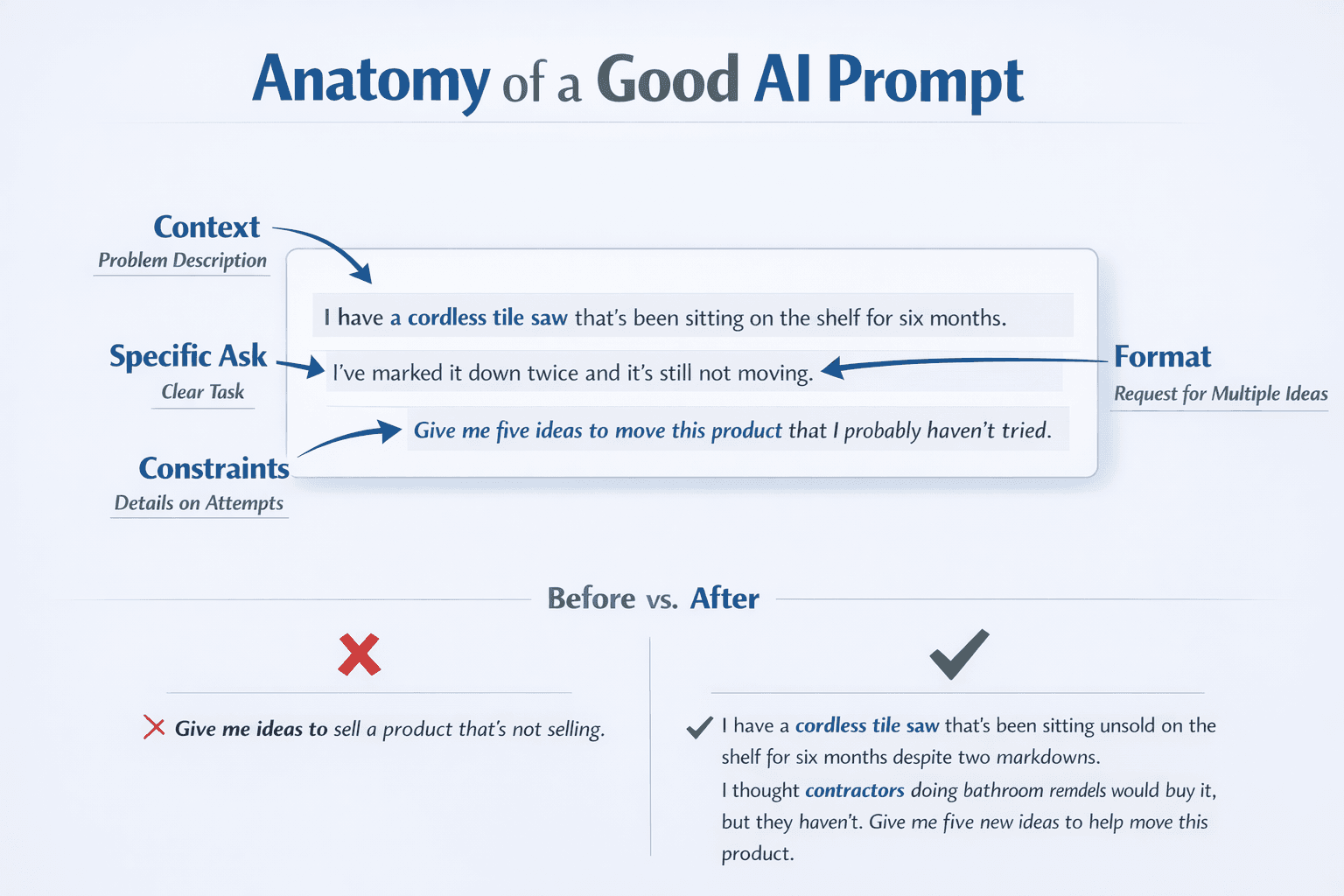

Get ideas for a product that won't move. Consider a product that isn't selling despite your efforts. Describe it—what it is, who you expected to buy it, what you've tried. Ask for five approaches you haven't considered.

"I have [product] that's been sitting on the shelf for six months. I've marked it down twice and it's still not moving. I thought [target customer] would buy it, but they haven't. Give me five ideas to move this product that I probably haven't tried."

Draft a tricky customer response. Find a difficult customer email from the past month. Paste it in and request three different response options.

"Here's an email from a frustrated customer: [paste email]. Give me three different ways to respond—one apologetic, one that holds firm on our policy, and one that offers a compromise. Keep each under 100 words."

Then try this: ask the AI something only you would know. What should you reorder this week? What's your margin on a specific product?

Observe how it responds—confident, helpful-sounding, and entirely uninformed. This limitation is important to experience directly.

Week 2: Effective Prompting

By now you've noticed inconsistent results—sometimes useful, sometimes generic. The difference typically comes down to how you framed the request. A prompt is the instruction you give the AI tool to perform a specific action.

Common mistakes:

Being too vague. "Help me with marketing" produces generic content. "Write a 60-word email to my contractor customers announcing we now stock Marshalltown trowels" produces something usable.

Omitting context. The AI doesn't know you run a paint store in a retirement community or a farm supply in dairy country. Provide that information. "Most of my customers are hobby farmers and retirees with a few acres" significantly changes the response.

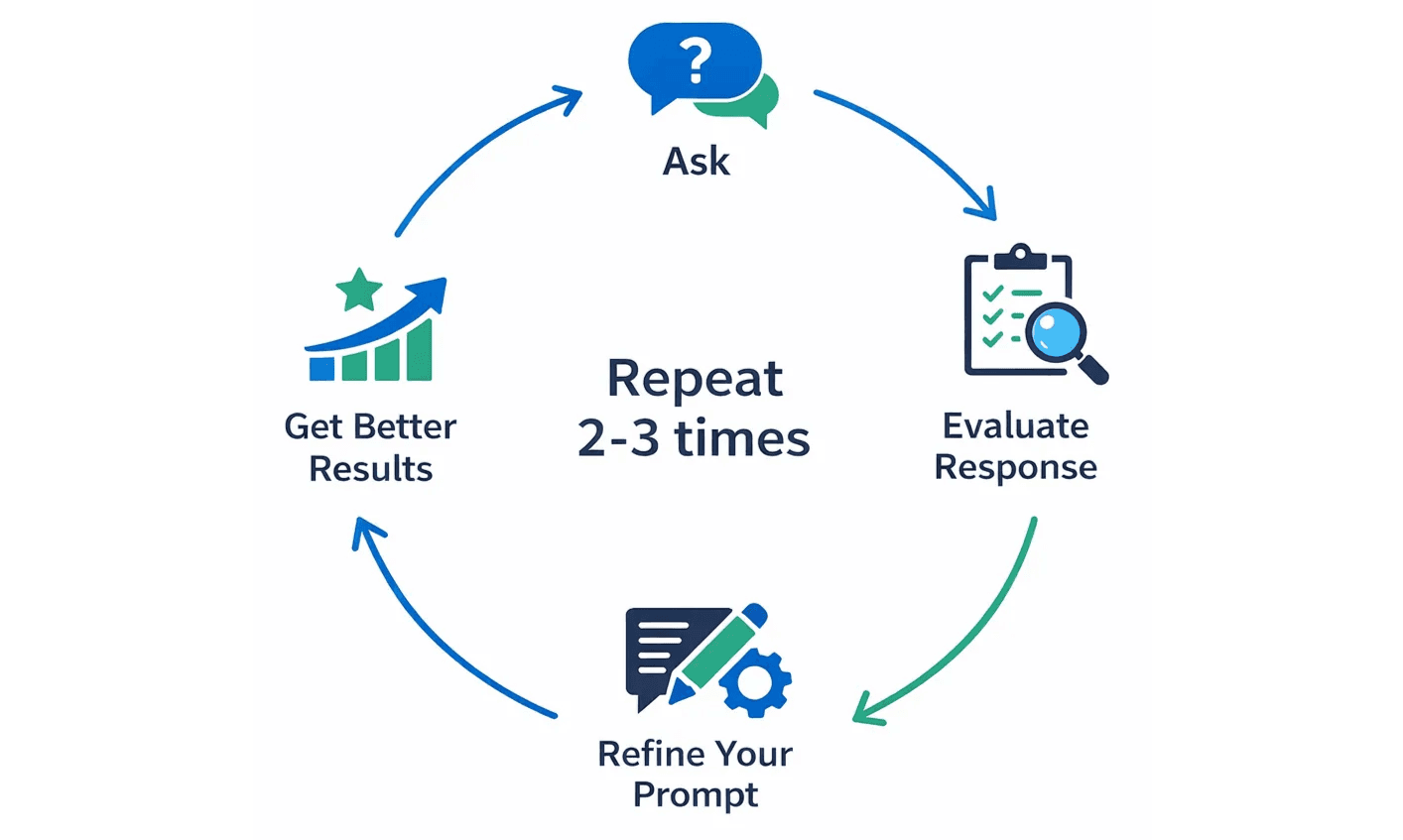

Accepting the first response. You wouldn't accept a first draft from a new employee without revision. Apply the same standard here. "Too long." "Less formal." "Include information about same-day pickup." Push for improvement.

Abandoning the process too quickly. A poor response doesn't mean AI is ineffective. It usually means you haven't found the right way to ask.

This week: Select three real tasks from your work—an email, a sign, a problem you're considering. Use AI on each, but continue past the first response. Go at least three rounds. Notice how the output improves with iteration.

Week 3: Developing Proficiency

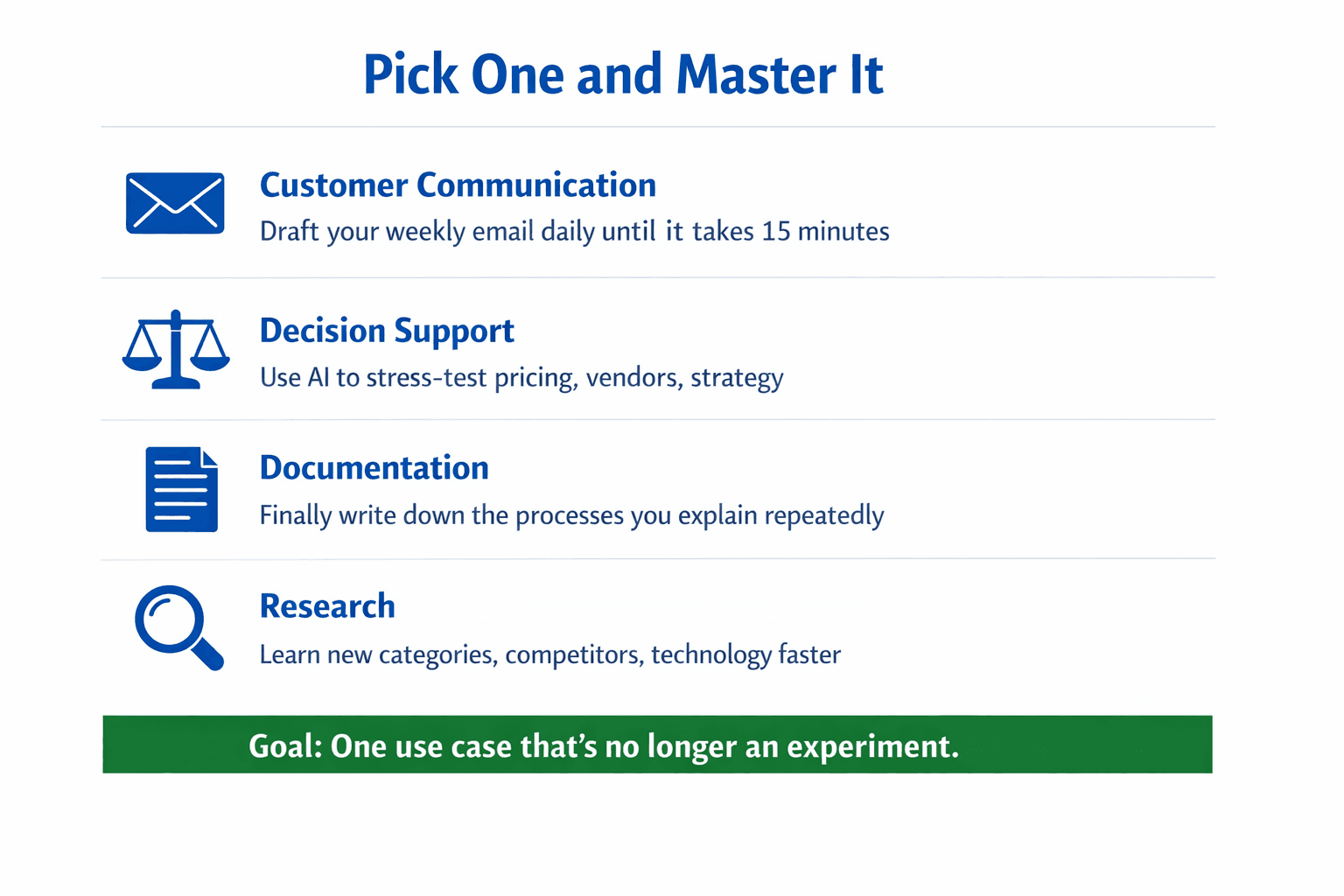

You've experimented broadly. Now select one use case and develop real proficiency.

Options to consider:

Regular customer communication. Use AI to draft your weekly email. Practice daily for a week. By Friday, it should take 15 minutes rather than an hour.

Decision support. Working through a pricing problem? Evaluating a vendor? Concerned about an underperforming category? Use AI as a thinking partner. Describe the situation thoroughly. Request options. Ask what could go wrong. Challenge its suggestions.

Documentation. The register closing process. Handling returns without receipts. Procedures you've explained to new employees dozens of times but never documented. Let AI create a first draft while you talk through the steps.

Research. A new product category you're unfamiliar with. A competitor gaining share. Technology your customers ask about. Use AI to accelerate your learning. Ask the fundamental questions you might hesitate to ask a sales representative.

The objective: By week's end, you should have one use case where AI is no longer experimental. It's simply how you handle that task.

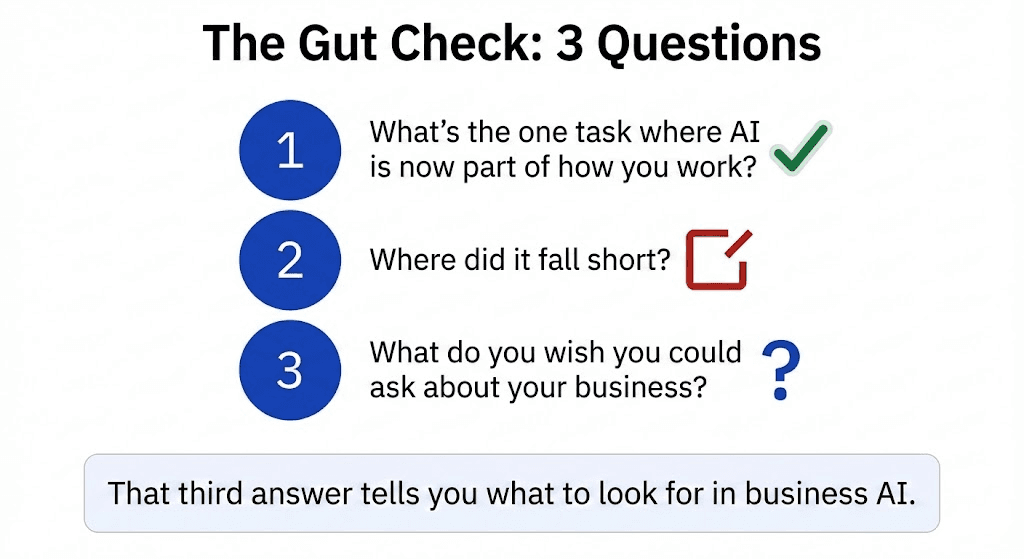

The Gut Check

By now, you've experienced both sides of AI—moments of genuine usefulness and moments of confident irrelevance.

Three weeks in, it's time for an honest assessment.

What task has AI become part of your regular workflow? Not something you could imagine using it for—something you actually use it for, consistently. If you can't identify a specific task, return to Week 3.

Where did it fall short? Identify it specifically. The task where it consistently produced poor results. The question it couldn't answer. The confident error. This isn't failure—it's learning where the boundaries are.

What do you wish you could ask? Not general business questions—specific questions about your store, your sales, your inventory, your customers. Questions whose answers would influence decisions you make this week.

If AI can't answer those questions, it isn't because they're too complex. It's because the tool lacks knowledge of your business.

Remember that answer. It will guide you when evaluating vendors selling "AI-powered" software.

Part 3: Evaluating AI Tools

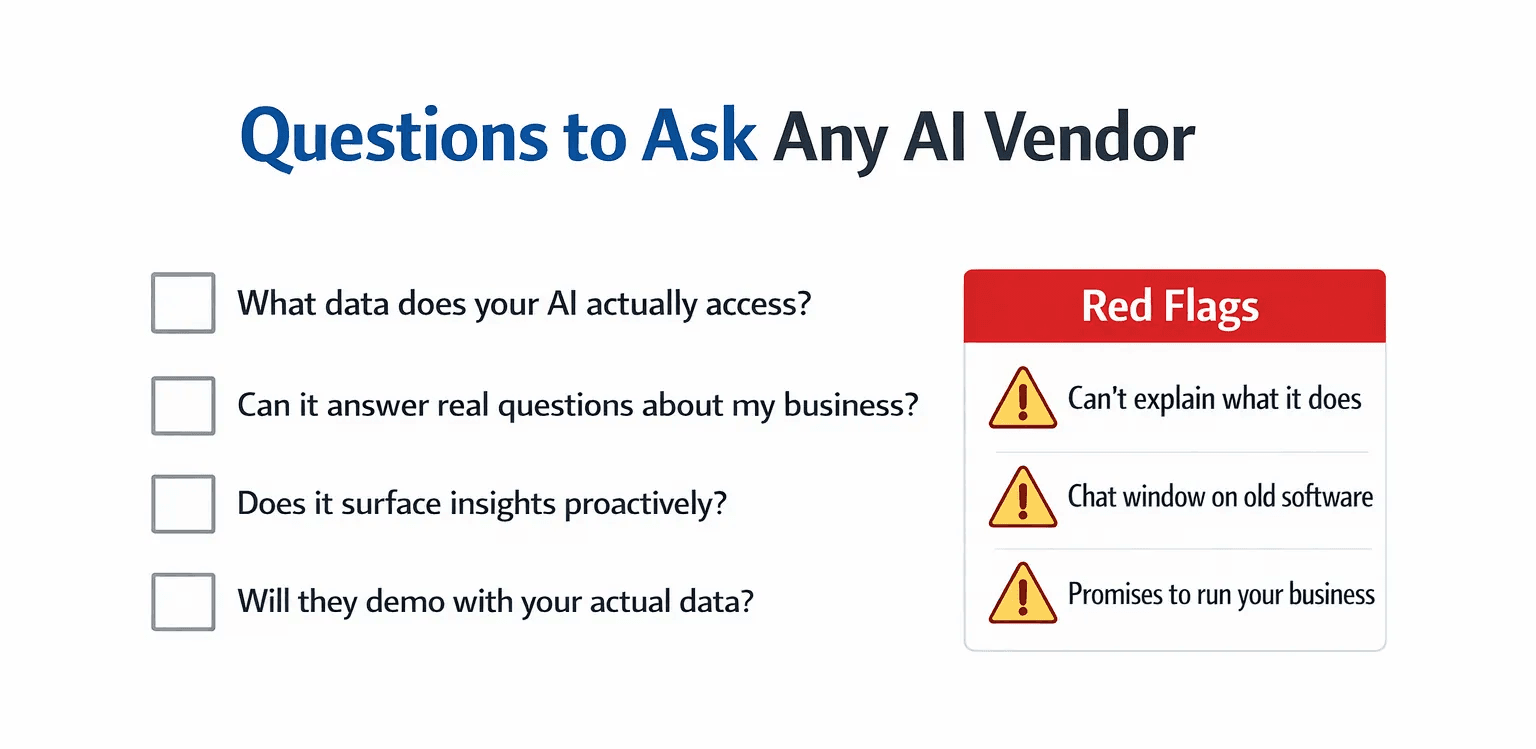

Eventually, a vendor will pitch AI-powered software. Here's how to determine whether it's substantive or marketing.

One of our customers, Josh, expressed it well. He said he's "generally a little skeptical of AI integrations as they are generally not as useful as software companies think they are and tend to come out a little half baked." His skepticism is warranted. Most of them are.

When evaluating a tool, ask:

What data does your AI access? If it isn't connected to your sales, inventory, and operations, it's a chatbot with better design.

Can it answer real questions about my business? "What were my top products last month?" "What should I reorder?" If it can't answer these, what value does it provide?

Does it surface information proactively? Effective AI identifies problems and opportunities without requiring perfect questions.

Will you demonstrate using my actual data? Not a polished presentation with sample data. Your sales. Your inventory. Hesitation on this point deserves scrutiny.

Warning signs:

They cannot clearly explain what the AI does.

The "AI" is a chat interface layered on existing software.

They promise it will run your business or replace your judgment.

They cannot articulate its limitations.

They request extensive access before demonstrating value.

Regarding your data:

Before connecting any AI tool, determine where your data goes. Who has access? Is it used to train models serving other customers? What happens if you discontinue service?

Your business information has value. Be thoughtful about who receives it.

About Rundoo AI

Rundoo is a point-of-sale and business management platform built for hardware stores, paint stores, home centers, farm and feed stores, and nurseries.

Rundoo AI works differently than general AI tools. When you ask a question—"What were my top sellers last month?" or "What should I reorder?"—the AI isn't generating an answer from its training data. It's translating your question into a structured request, then our reporting backend does the actual work using your real data.

This is intentional. We use AI for what it's good at—understanding natural language—and avoid what it's bad at—making up facts. The reports, the summaries, the purchase order suggestions: that's your actual data, processed by systems built for accuracy, surfaced through an interface that lets you ask questions in plain English.

Store owners use Rundoo AI for daily summaries that highlight what needs attention: underperforming products, trending categories, exceptions easy to miss while managing the floor. They create reports by asking questions in plain English. They generate purchase orders based on actual sales patterns, current inventory, and recent movement.

Josh, the skeptic mentioned earlier, told us he was "extremely impressed with the thoroughness and its ability to parse only the data that is relevant to my ask." Another owner, Jason, called the daily AI summary report "one of the best tools I think I've ever seen."

Your data remains yours. It isn't shared with third parties or used to train models for other customers.

If this guide helped clarify what AI should and shouldn't do, and you'd like to see what AI looks like when it actually knows your business, we'd be glad to show you.

Find out what Rundoo can do for your business

Learn how Rundoo can help you save time, money and hassle running your business.